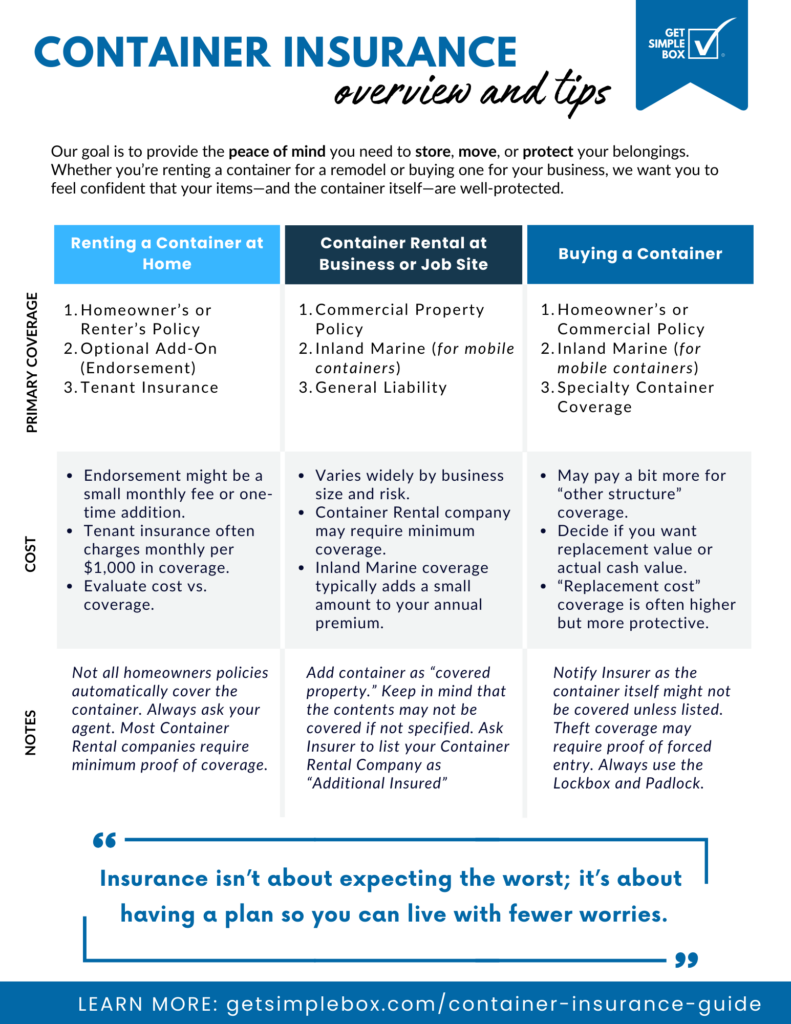

When it comes to storing your things or moving from place to place, container insurance might not be the first thing on your mind. But as Dave Ramsey says, “Insurance is not an investment; it’s a necessity.” This is especially true if you’re using a storage container rental, moving containers, or even a shipping container for sale at your home or business.

Table of Contents

Why Insurance Matters

“Insurance is the one product you buy, hoping you never have to use it—yet you’ll be grateful you have it if the worst happens.” This quote reminds us that even though containers are strong and weatherproof, accidents or theft can still happen. “Insurance isn’t about expecting the worst; it’s about having a plan so you can live with fewer worries.”

Below are three important facts to show how common it is to rely on insurance for both personal and business use:

- 1 in 9 Americans move each year, and many now choose portable containers for extra convenience.

- Construction sites lose $1 billion worth of tools, materials, and gear every year to job site theft.

- Container-based or self-storage insurance can cost around $10 to $20 each month for $5,000 of coverage, depending on your location and policy limits.

Together, these numbers show why having the right insurance is essential. Whether you’re using a storage container rental at home, buying a unit for your business, or planning a big move, it’s a smart idea to learn about your coverage.

Let’s dive into the top questions we hear most often about container insurance. We’ll answer them for homeowners, movers, and commercial customers who want to know how to protect their things and avoid surprises.

Stay tuned as we share helpful container insurance tips to make sure you’re covered!

Container Insurance Q&A: Common Customer Questions

Below are some of the most common questions people ask when they’re getting ready to rent, buy, or move with a container. We’ve kept the answers short and easy to understand, whether you’re a homeowner, mover, or commercial user.

Q1: “Will my homeowner’s policy cover my container?”

A: Many homeowners insurance policies do not automatically cover a shipping container or rental container—especially if it’s outside your main property. Some policies only protect 10% of your personal property if it’s stored off-site. Talk with your insurance agent about adding a detached structure endorsement or a separate rider.

Q2: “What if I’m only renting a container for a short time?”

A: Even if it’s a temporary rental, check if your current policy covers items stored off-premises. If not, you can often buy a short-term endorsement or look into a tenant insurance plan. Also ask if the container company offers “content protection” and compare it to your own policy options.

Q3: “I’m moving with a container—do I need extra coverage?”

A: When using moving containers, your belongings might be covered by your homeowners insurance, but only up to a certain limit. If you’re moving across state lines or storing your items in transit, look into inland marine or transit coverage. This type of policy helps protect against damage on the road or at a temporary site.

Q4: “Should I rely on a container company’s ‘protection plan’?”

A: Many container companies have plans that look like insurance, but they’re often called “protection plans.” These can have strict exclusions (mold, vermin, forced-entry requirements) and may not be regulated like standard insurance. Compare their plan’s details, cost, and coverage limits to what you could add through your own policy or a third-party insurer.

Q5: “I run a small business—what if I store my inventory in a container?”

A: For commercial storage, you’ll likely need a business liability or commercial property policy that covers on-site equipment and your stored items. If you move the container around (for job sites or pop-up events), consider inland marine coverage, which protects mobile property as it travels.

Q6: “Do job site containers need special insurance?”

A: Yes. Job site containers can be a target for theft, with an estimated $1 billion in stolen materials and tools yearly. Your commercial insurance or contractors equipment policy should list the container (if you own it) and include tools and materials stored inside. Otherwise, you risk paying out of pocket if it’s damaged or broken into.

Q7: “What if I buy my own container—does that change my coverage?”

A: Buying a Shipping Container can have cost and tax benefits, but you’ll want to ask your agent to list it as a detached structure on your home or commercial policy. Think of it like adding a shed or ADU (Accessory Dwelling Unit). This ensures the container itself is covered, not just the items inside.

Q8: “Are there any common ‘gaps’ or hidden issues I should know about?”

A: A few red flags to be aware of:

Forced Entry Clauses: If there’s no cut lock or visible break-in, theft claims may be denied. We recommend always using a lockbox and a lock that specifically fits inside of it (ask our storage team for our favorite container padlock).

Exclusions for Valuables: Jewelry, firearms, and collectibles often require separate or scheduled coverage. We recommend keeping those items in a locked safe or safety deposit box.

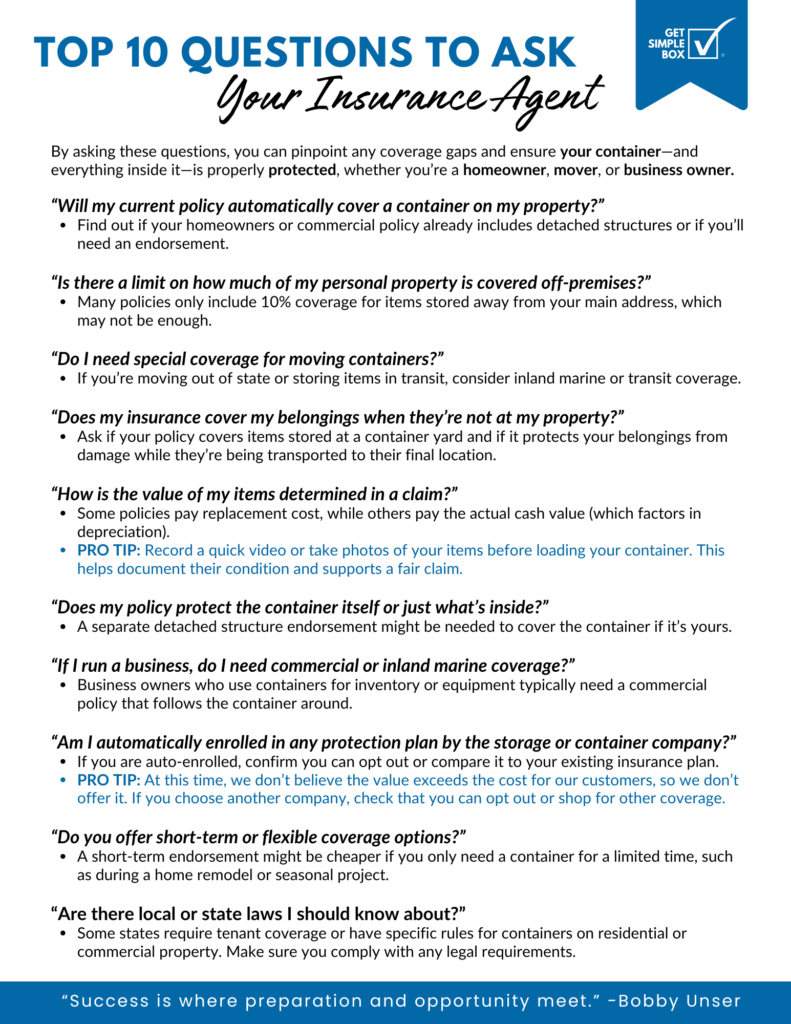

Top 10 Questions to Ask Your Insurance Agent

If you’re thinking about renting, buying, or moving with a shipping container, asking the right questions can save you time, money, and stress. Here are 10 helpful questions to bring up with your insurance agent:

- “Will my current policy automatically cover a container on my property?”

- Find out if your homeowners or commercial policy already includes detached structures or if you’ll need an endorsement.

- “Is there a limit on how much of my personal property is covered off-premises?”

- Many policies only include 10% coverage for items stored away from your main address, which may not be enough.

- “Do I need special coverage for moving containers?”

- If you’re moving out of state or storing items in transit, consider inland marine or transit coverage.

- “Does my insurance cover my belongings when they’re not at my property?”

- Ask if your policy covers items stored at a container yard and if it protects your belongings from damage while they’re being transported to their final location.

- “How is the value of my items determined in a claim?”

- Some policies pay replacement cost, while others pay the actual cash value (which factors in depreciation).

- “Does my policy protect the container itself or just what’s inside?”

- A separate detached structure endorsement might be needed to cover the container if it’s yours.

- “If I run a business, do I need commercial or inland marine coverage?”

- Business owners who use containers for inventory or equipment typically need a commercial policy that follows the container around.

- “Am I automatically enrolled in any protection plan by the storage or container company?”

- If you are auto-enrolled, confirm you can opt out or compare it to your existing insurance plan.

- “Do you offer short-term or flexible coverage options?”

- A short-term endorsement might be cheaper if you only need a container for a limited time, such as during a home remodel or seasonal project.

- “Are there local or state laws I should know about?”

- Some states require tenant coverage or have specific rules for containers on residential or commercial property. Make sure you comply with any legal requirements.

By going over these 10 questions with your insurance agent, you can pinpoint any coverage gaps, plan for the worst-case scenarios, and ensure your container is properly insured—no matter how you decide to use it. If you’re ready to rent, move, or buy a container, check out our additional resources below:

With a bit of planning and the right questions, you’ll have the peace of mind you need to protect what matters most.

Download the Top Questions to Ask Your Insurance Agent

Whether you're transporting your goods or using containers for storage, this guide will help you navigate risks, protect your investment, and avoid unexpected costs.

Download NowShare this Post:

Related Posts

The Complete Guide to Starting a Portable Storage Licensing Business in Salt Lake City, UT What’s the best way to

Business Stewardship at Get Simple Box: Why Steward Means More Than CEO Titles matter, but not for the reasons we

The Complete Guide to the Portable Storage Business in Boise, ID: What Works & How to Replicate It Why is

Shipping Container Electrical Power Inlet: The Safest Way to Power a Storage Container A shipping container is already one of

Storage Container in Whidbey Island, WA: A Local Guide to Secure, Weather-Ready Storage A storage container in Whidbey Island, WA

Storage Container Rental for Churches and Nonprofits in Phoenix, AZ A storage container rental for churches and nonprofits in Phoenix,